The PayPal Salesforce integration is a powerful tool that allows businesses to seamlessly connect their PayPal and Salesforce accounts, streamlining their sales processes and improving overall efficiency.

59 percent of consumers say they would switch to a different brand for a better payment experience—did you know that? Additionally, 57% of customers feel that payment security is the most significant factor when choosing a company to do business with.

You can provide your users with a payment portal that satisfies their demands and offers them the security and usability they expect by integrating Salesforce.org with PayPal.

How to set up the PayPal Salesforce integration step-by-step

Let’s start with a problem statement

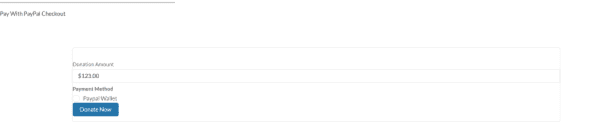

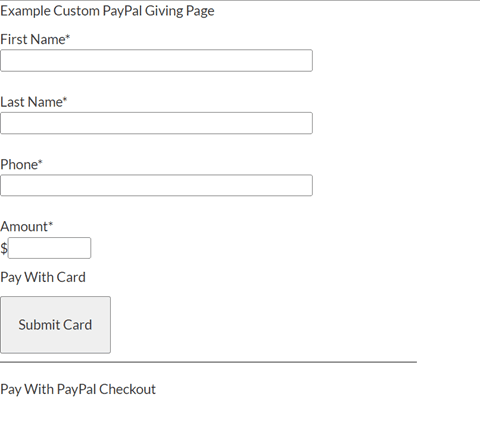

Assuming you want a portal where your customers can make payments, you also want the payer’s name and the amount they spent to be visible in your CRM so that they can use that information to send thank-you letters to each payer. Also, you want the payment information to be protected.

Solution design

Integrating salesforce.org with PayPal would enable you to do just that. The information of customers who choose to pay with PayPal will be shared and readily available.

Implementation details

Identify the API methods

We can refer to the PayPal documentation to find the API methods that can be used for payment-related tasks.

PayPal provides both APIs and SDKs

Define the data model

When a user clicks on a link created from a Salesforce site, they are directed to the PayPal gateway, where they can complete their transaction. A special object needs to be built in Salesforce to save the payment information. Some of the fields included in this custom object are payer name, amount, programme name (optional), day and time, payment date and time, etc.

Create Apex classes

Apex classes can be created to enable payments and update payment details inside the org.

a) Apex classes have methods for generating payment requests, receiving payment responses, and updating payment objects with payment information such as payment ID, payer name, payment amount, payment date, etc.

b) Depending on the payment ID, there will be different ways to check the payment status and update the payment object with the new payment status. These methods can be added to the Apex class for confirming payments.

Implement the integration

The user interface for starting payment-related actions, such as making payments and updating data in the org, can be created as a custom Lightning component. This UI component can call the required methods built on Apex classes (referenced in the code snippet below) to carry out payment-related actions.

Integration test Method

In Salesforce, we can create test data and do different payment-related operations like initiating payments and modifying payment information in the org. Incorrect payment responses, invalid payment requests, and other error-handling scenarios are also possible.

You’ll also be able to handle wrong payment responses, invalid payment requests, and other types of errors.

Relevant steps

- Design a Lightning button, then add it to the client portal website.

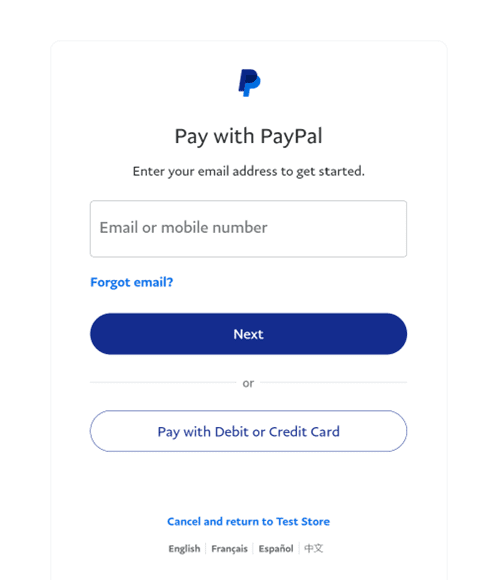

- When a user clicks on that link, they are directed to the PayPal website, where they can enter their payment details (name, amount, etc.) and complete the transaction.

- When a payment is received, we will email the payers and record the information in the custom object we created in Salesforce named payment.

Code snippet for Paypal API integration (high level)

Here's a high-level code snippet for creating a payment request using PayPal REST API:

import requests

import json

# Set up PayPal API credentials

client_id = 'YOUR_CLIENT_ID'

client_secret = 'YOUR_CLIENT_SECRET'

token_url = 'https://api.paypal.com/v1/oauth2/token'

payment_url = 'https://api.paypal.com/v1/payments/payment'

# Authenticate with PayPal API and get access token

auth_response = requests.post(token_url, auth=(client_id, client_secret), data={'grant_type': 'client_credentials'})

access_token = json.loads(auth_response.text)['access_token']

# Set up payment request payload

payment_request = {

'intent': 'sale',

'payer': {

'payment_method': 'paypal'

},

'transactions': [{

'amount': {

'total': '10.00',

'currency': 'USD'

},

'description': 'Payment for test item'

}],

'redirect_urls': {

'return_url': 'https://example.com/success',

'cancel_url': 'https://example.com/cancel'

}

}

# Send payment request to PayPal API

headers = {'Content-Type': 'application/json', 'Authorization': f'Bearer {access_token}'}

response = requests.post(payment_url, headers=headers, data=json.dumps(payment_request))

# Parse response and extract payment ID and redirect URL

if response.status_code == 201:

payment_data = json.loads(response.text)

payment_id = payment_data['id']

redirect_url = next(link['href'] for link in payment_data['links'] if link['rel'] == 'approval_url')

print(f'Payment created with ID {payment_id}, redirect to {redirect_url}')

else:

print(f'Error creating payment: {response.text}')A visual guide to PayPal integration

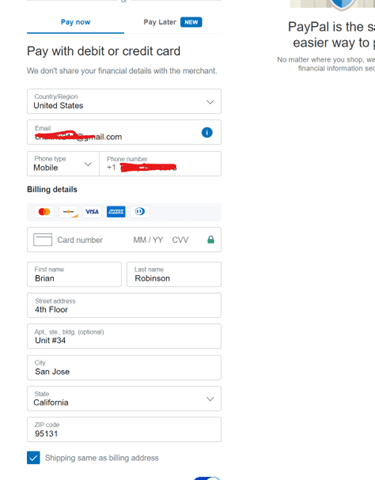

Pay with a debit card

Login to PayPal

Pay with Debit or Credit Card and continue payment

This code sets up the necessary PayPal API credentials. It authenticates with the API to get an access pass and makes a payment request payload with the necessary transaction information. After the payment request has been sent to the PayPal API, extract the payment ID and redirect the URL. These are then sent to the console.

Note This code sample suggests that the payment request is for a single transaction with a fixed amount and description. If your use case requires more complicated payment logic, you will need to change it.

What are PayPal and Salesforce, and how does their integration work?

PayPal is a well-known payment processing system that allows individuals and businesses to send and receive payments online securely.

Salesforce is a well-known customer relationship management (CRM) platform that businesses use to track customer data and interactions.

By allowing businesses to process payments, manage customer data, and automate workflows from a single platform, PayPal integrates into Salesforce and streamlines payment processing and customer management workflows. Hence the term “PayPal Salesforce integration.”

This is possible through the use of a PayPal Salesforce Connector or a Salesforce PayPal Connector, which connects the two platforms and allows payment gateways and payment processing to work together. (PayPal Payment Processing – B2C Commerce)

Benefits of integrating PayPal with Salesforce for businesses

Businesses get significant benefits from integrating PayPal with Salesforce Consider these: PayPal-Salesforce integration benefits:

- Improved efficiency: Automates data entry, billing, and invoicing, which makes things more efficient. This is a great way to make online payments because it saves time and makes the team more productive.

- Better customer experience: Adding PayPal to Salesforce makes it easier for your customers to pay. They can pay on your website, and Salesforce automatically updates their account information and transaction history. Customer satisfaction and managing relationships get better.

- Enhanced reporting and analytics: Salesforce helps you figure out how customers act, what they like, and how often they make purchases.. When you connect PayPal to Salesforce, you can see what your customers are buying, at what time of day, etc. This lets you make decisions that are good for your business and based on facts.

- Improved security: PayPal encrypts and protects sensitive information about your customers. When PayPal is integrated with Salesforce, customer payment data is kept safe. This makes customers trust you and keeps your data from being stolen.

What tools can help with the PayPal and Salesforce integration processes?

Some of the tools that can help with the integration of PayPal with Salesforce include Payment gateway applications and credit card processing software, such as

These tools allow you to automate tasks, collect payments, and update customer records in real time. They also provide features such as recurring billing and invoicing, data mapping, and synchronisation.

Key takeaways

- PayPal is a payment processing system, while Salesforce is a customer relationship management platform that tracks customer data and interactions.

- Integrating the two platforms can be done through a PayPal Salesforce Connector or a Salesforce PayPal Connector.

- To set up the integration, API methods must be identified, a data model must be defined, and Apex classes must be created.

- A custom Lightning component can be created for starting payment-related actions, and test data can be used for integration testing.

- Integrating PayPal with Salesforce can improve efficiency, customer experience, reporting and analytics, and security.

- Payment gateway tools such as Zapier, Formstack, Chargent, and Jitterbit can simplify the integration process.

- Security concerns such as data breaches, unauthorised access, compliance problems, and phishing attacks exist, and businesses should follow best practises for data security and use trusted third-party tools.

- PayPal and Salesforce integration allows businesses to seamlessly connect their PayPal and Salesforce accounts, streamlining sales processes and improving efficiency.